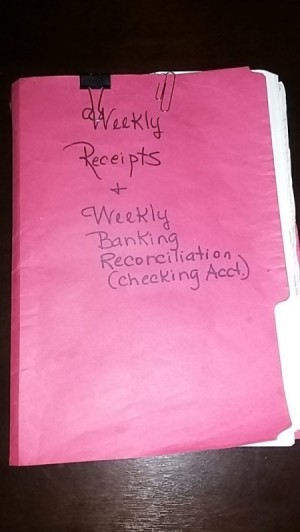

Living on a fixed income can be a challenge. If you reconcile your checking account once a week and write down each transaction, at the end of the month at your bank statement should coincide with your weekly banking transactions that are verified on a weekly basis. I have a red folder with a spiral notebook inside which I record my weekly transactions on my checking account, including debits, bank drafts or any any monies withdrawn from my checking account, which I receive from calling a bank representative. I also get the balance for that week. All debit receipts are kept on a clip and highlighted with the amount and the date unclipped on the inside of the red folder.

Living on a fixed income can be a challenge. If you reconcile your checking account once a week and write down each transaction, at the end of the month at your bank statement should coincide with your weekly banking transactions that are verified on a weekly basis. I have a red folder with a spiral notebook inside which I record my weekly transactions on my checking account, including debits, bank drafts or any any monies withdrawn from my checking account, which I receive from calling a bank representative. I also get the balance for that week. All debit receipts are kept on a clip and highlighted with the amount and the date unclipped on the inside of the red folder.

My husband and I have gotten into the habit of using this red folder on a weekly, and sometimes on a daily basis. We come in from a shopping trip and immediately take out the debit receipts, clip them onto the red folder and highlight them all. We record in the check register any transactions that we wrote a check for. This keeps us on track with our checking account and is also valuable information for our financial advisor.

I am legally blind and have to have things in order an organized in order to function. This method of managing our finances on a weekly basis is very effective. My vision will not allow me to use the computer in regard to finances because of the lack of vision to see the numbers.

Share on ThriftyFunThis page contains the following solutions. Have something to add? Please share your solution!

Until I recently retired I had never worked to a strict budget and although I was well paid I was often caught short of money.

Ask a QuestionHere are the questions asked by community members. Read on to see the answers provided by the ThriftyFun community or ask a new question.

I am trying to help out a friend with big financial problems due to poor choices over many years. My question to all of you successful TF folks is, is it possible to manage on the income she has coming in and get this nightmare turned around?

She is a 60 yr. old woman in poor physical health who had been unable to find employment for 4 years. She has no resources to fall back on. She is no longer eligible for unemployment benefits as they have been exhausted. After hundreds of job applications she finally was hired, but it is a very physical job and it is questionable just how long she can make it there. The pay is low.

Her income is very close to $1,000 a month, but her mortgage payment is $800 a month, plus her utilities. She is 2 months behind on the mortgage. The bank is threatening to foreclose as this has been a long and winding road they've been on before. She lives with her 22 year old son for the summer, but he leaves to go away again for college in fall. Fortunately he has been able to work out his finances for school, but he does need to save some money over the summer here. Is it possible to be frugal enough to make it on that much money? The geographic location is upstate New York as I know locations do make a difference.

By Arlinn

No matter where you live, there is no way you can manage with $1,000 monthly income and $800.00 monthly mortgage, plus utilities. There is homeowners insurance, car insurance, car upkeep, food, a minimum of clothing.

In the winter people can get "energy assistance", it is called different things in different areas, that is for heat, however, most of the time it won't cover all of the heating expenses. She should check with the department of social services in her town. My advice is to sell the house, hurry up and spend what is left after paying off the mortgage and whatever other bills she has, and apply for a HUD apartment. The rent for them is figured on 30% of a person's income, and there are income restrictions.

Her son's income would also have to be figured, so when he is living with her and working the rent would be a little higher, but then she could apply to have it lowered when he goes back to school. It might be best to apply for a one bedroom apartment and get a couch that makes into a bed for her son to sleep on when he is there.

In these HUD apartments the heat, water, sewer, and garbage is included in the rent. The only utilities she would be responsible for is electricity and phone. She also wouldn't have to worry about yard work and snow removal.

If there is an Experience Works! office in your area, they are a government office that trains and helps senior citizens find work that they can handle. The training period averages about 20 hours per week. Sometimes it is receptionist work, sometimes other light to heavy work, depending on the physical condition of the individual.

There are income limitations there, too, in order to receive the help, and I can't remember what it is, and by now it might have changed. I spent several years working in non-profit offices as a receptionist, at minimum wage, through this office. As long as you are on the training program whatever you are paid doesn't affect any other government benefits that a person receives.

I am living on disability payments that come to $1,204.00 a month. No, you need Help.

The house is a major drain. Look for more affordable housing & take a room mate. Lots of us seniors need each other. My sister & I use a food bank for most of our food, and eat at a senior center for lunch. I always apply for assistance for medicines & ask the doctor for free samples which he is glad to provide. Apply for food stamps. Go to the yellow pages of the phone book and investigate every possible source under US gov't.